Mississauga restaurant blast kill 15

Two unidentified men walked into a restaurant on Thursday in the Canadian city of Mississauga and set off a bomb, wounding more than a dozen people, and then fleeing, authorities said.

- 2 suspects attended the scene, detonated an Improvised Explosive Device within the restaurant. Several injured were taken to local hospital and 3 in critical condition were taken to a Toronto Trauma Centre.

The blast went off in the Bombay Bhel restaurant at about 10:30 pm.

Fifteen people were taken to hospital, three of them with critical injuries, the Peel Regional Paramedic Service said in a tweet.

The two male suspects went into the restaurant and detonated their improvised explosive device, Peel Regional Police said in a tweet. The men then fled.

There was no immediate claim of responsibility.Police posted a photograph on Twitter showing two people with dark zip-up hoodies walking into an establishment with one of them appearing to be carrying an object.

The attack in Mississauga, Canada’s sixth largest city, comes a month after a driver plowed his white Ryder rental van into a lunch-hour crowd in Toronto, killing 10 people and injuring 15. Mississauga is in Lake Ontario about 20 miles west of Toronto.

media agencies

China debt crackdown spree

China is cutting off funds to financial companies and banks tied to regional governments in a crackdown on risky debt, rattling markets as institutions scramble for cash.

On May 11, China Zheshang Bank turned to the country’s interbank market for money to issue 3 billion yuan ($470 million) in certificates of deposit. It came back with just 700 million yuan and change.

Financial regulators “are cutting off financing options to banks that do not listen to what they say,” an executive at a major commercial bank said. China’s massive state-owned banks, with their sterling ratings and massive deposits, are largely responsible for keeping the interbank market flush, giving the state significant leverage over errant financial institutions.

China is targeting institutions tightly linked to regional governments, and the banks that work with them, in a widening campaign against excess leverage in financial markets. China Zheshang is strongly identified with Zhejiang Province, while Tianjin Real Estate is backed by the government of the city of Tianjin.

Chinese regional governments that have hit limits on debt issuance have traditionally founded quasi-private companies to handle infrastructure and public works, borrowing as needed. These local government financing vehicles, as they are known, have raised roughly 10 trillion yuan, often through risky high-yield savings products sold to unsuspecting retail customers. Banks have also helped governments procure off-the-books financing. Regulators are working now to bring these shadowy products to light and to dispose of the riskiest among them.

But as necessary as this campaign is to China’s financial stability, a blow to the broader economy is inevitable. From the beginning of 2018 through last week, financial institutions and companies sold just under 460 billion yuan in securitized products, a drop of 10% from a year earlier. Financial affiliates of e-commerce leader Alibaba Group Holding have cut issuance 20%. This means less funding is available to smaller businesses and individuals.

The Shanghai Composite Index has remained below its 2017 close over the past few months, suggesting investors are aware of the challenges deleveraging will bring. Not even the prospect of China’s inclusion in the MSCI Emerging Markets Index, beginning in June, has sparked much buying.

Chinese blue chips such as Alibaba and Baidu are weighing stock market listings in mainland China, which could draw tens of billions of yuan each. But some are concerned that these debuts would throw the market out of balance, and at the same time expose the companies to greater control by China’s government and Communist Party.

Beijing has moved to soften deleveraging’s impact on smaller banks by cutting capital reserve requirements. But this fix, like the crackdown itself, is subject to wide regulatory discretion, keeping markets guessing as to what the next development will be.

Venezuela’s Maduro sworn in President

Venezuela’s Nicolas Maduro was sworn in Thursday for a second term as president of the crisis-wracked Latin American country, just days after winning an election boycotted by the opposition and decried abroad.

Maduro swore “to respect and enforce the Constitution and lead all revolutionary changes” in a ceremony before the Constituent Assembly, which he set up himself last year and stacked with his supporters.

In power since 2013, the socialist leader said those changes should lead Venezuela to “the peace, prosperity and happiness of our people.”

Maduro later plans to attend an event at the defense ministry in Caracas to receive a “reaffirmation of loyalty” from the armed forces’ high command.

The 55-year-old former bus driver was re-elected Sunday in a vote boycotted by the main opposition and widely condemned by the international community, including the United States, which denounced it as a “sham.”

His election for a second six-year term maintains him in the presidency until 2025.

Venezuela’s constitution states that the president must be sworn in before parliament, where the opposition holds the majority and which has in practice been replaced by the Constituent Assembly.

The parliament was declared in contempt by the Supreme Court two years ago, and consequently its decisions are now considered null and void.

Under the constitution, the inauguration of Maduro’s new term was to be held next January. Prior to the swearing-in, the Assembly approved by a show of hands a decree clarifying the new mandate would begin on January 10 even if Maduro was to be sworn in immediately.

H.M. Queen Máxima – UNSGSA visiting India

25 May 2018

to Explore Financial Inclusion Advances and Innovations during India Visit, 28-30 May

H.M. Queen Máxima, the UN Secretary-General’s Special Advocate for Inclusive Finance for Development (UNSGSA) will visit India 28–30 May 2018 to explore the country’s progress on financial inclusion and the innovations that are driving those advances.

India has been pursuing an active policy to expand access and use of formal financial services, and the most recent figures from the Global Findex database show that 80 per cent of adults now have an account, up from 53 per cent just three years ago. The gender gap has narrowed from 20 to 6 percentage points.

The Special Advocate’s visit, which follows up an earlier visit in 2014, will highlight the example that India’s progress can offer other countries. Its success largely hinges on a combination of ambitious and supportive policies and an interconnected digital public infrastructure known as the India Stack. This includes elements such as a national biometric ID, which makes it much easier for people to open accounts, virtual payments addressing, and digital payments interoperability.

In addition, in 2014 the government of Prime Minister Narendra Modi launched the Pradhan mantri Jan-Dhan Yojan programme, which aims to provide a basic bank account for every household in India. Leveraging the Stack, those accounts are now used to deliver government social benefits directly to the poor.

While in Delhi, Queen Máxima will meet with representatives of NITI Aayog, a government policy think-tank; the Indian Software Products Industry Round Table (iSPIRT), a think-tank behind India Stack’s development; and representatives of the UN, other international development organizations, and financial institutions. She is also expected to meet with Prime Minister Narendra Modi and interim Finance Minister Piyush Goyal.

In addition she will visit a cluster of small businesses in Meerut, Uttar Pradesh, that collaborate to manufacture different kinds of sports equipment. An initiative called Aye Finance serves micro-entrepreneurs by developing a deep understanding of specific clusters and then using data-driven underwriting to provide credit to customers in those clusters.

In Mumbai, the Special Advocate will meet with the leaders of Indian companies involved with the CEO Partnership for Financial Inclusion. This group, consisting of ten heads of international companies, met for the first time at the World Economic Forum in Davos at the invitation of Queen Máxima in January. She will also convene a roundtable with heads of private financial services providers in India about the development of customer-centric financial products with the aim of expanding usage, which remains relatively low in India.

She will also visit a group of dabbawalas, lunch deliverymen who travel throughout Mumbai to deliver home-cooked meals. Traditionally they are paid in cash, which presents risks and takes time to handle. The Mumbai Dabbawala Associationworked with the mobile-only bank PayTM to offer the dabbawalas a digital bank account so that customers can pay using a QR code instead of cash.

China lends Pakistan $1.6bn

China has given Pakistan a credit line worth $1.6 billion to stave off a balance of payments crisis, two Pakistani central bank sources said on Thursday, with cash earmarked for boosting fast-depleting foreign currency reserves.

Two State Bank of Pakistan (SBP) sources told Reuters the credit facility that accompanies a currency swap agreement between SBP and China’s central bank has been hiked to 20 billion yuan ($3.13 billion) from 10 billion yuan.

“This arrangement has been finalised,” said one SBP source, who spoke on condition of anonymity. A second source confirmed the agreement and the figures.

Pakistan’s National Security Advisor Nasser Khan Janjua on Wednesday met with Yang Jiechi, member of the Political Bureau of the Communist Party of China (CPC) central committee, wherein the two figures agreed to deepen all-round cooperation between the two countries.

Janjua said that Pakistan has always stood by China and is willing to work with the friendly nation to take advantage of the China-Pakistan Economic Corridor, in order to further cooperation in various fields and promote Pakistan-China relations.

Yang Jiechi, who is also director of the Office of the Foreign Affairs Commission of the CPC central committee, said that since President Xi Jinping’s visit to Pakistan in 2015, the China-Pakistan all-weather strategic cooperative partnership has made great progress, the official Xinhua news agency reported.

He further said, “In the new situation, China and Pakistan should maintain the momentum of high-level exchanges, strengthen strategic communication and coordination, deepen all-round cooperation, and advance the construction of the CPEC.”

On Wednesday, Janjua also attended a meeting of the Shanghai Cooperation Organisation NSAs, which discussed security cooperation between SCO member states.

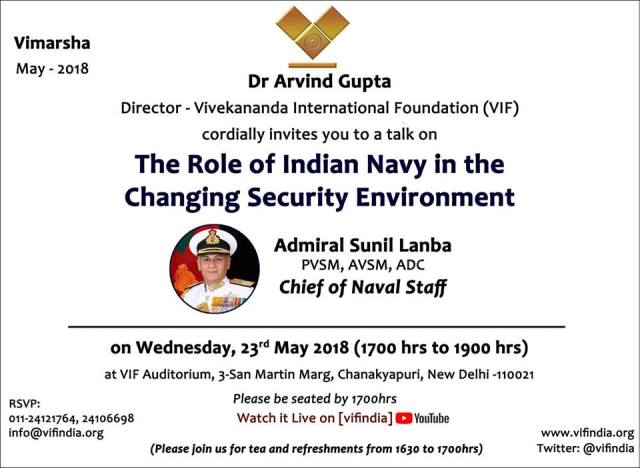

The Role of Indian Navy in the Changing Security Environment

Sagar Media Inc: Maritime policy Maritime deterrence is important strategy features in Maritime its application and coordinate other force activities on sea encompasses all of Navy and other forces. Admiral Sunil Lanba gave vivid description of Navy history from Chola dynasty playing an important role and thereafter Maratha too with significant presence but later with the art of Maritime rested with Europeans and thus colonial era began.

His address dwell on the global dynamic with global security strategy was the center of his elaborate address with Indian advancement in strides after rapid growth of Chinese influence in the area of maritime from 2008 onward, Indian government from 2012 onward moved with baby steps has taken bold initiative since 2015.

With the address and his tone about the national security with latest maritime weaponry, surveillance and coordination with many maritime neighbor nations and our exercises, training foreign navy personals along with a bird view on trades, piracy, illegal drugs trades, oil drilling and fishing are some of the challenges each day coastguards with along with navy face, make an excellent efforts to keep watch and execute national maritime plan for coastal belt of our nation is a commendable efforts.

Further more he said, thousand vessels with navy training on various wings department is in fast pace of rapid technology transfer. Navy is also moving with Fighter carriers and submarines indigenous designed and manufactured with radars and missile launchers ability along with surveillance of Indian oceans. The coordination of Indian navy on various counts with neighbor nations to best of its ability is the pride of navy well explained by Admiral Sunil Lanba in best diction.

Further more, the question- answer session of about more than an hours, a spell bound experience in the august gathering of three service persons present, the researchers, the students and media in full glare enjoyed each bit of knowledge so condensed in two hours about Indian Navy from the chief Perspective.

Asia-Pacific,NATO allies combat Cyberattacks

NATO drills in late April, the nation of “Crimsonia” launched thousands of cyberattacks on the vital infrastructure of “Berylia.” And for the first time, Australia took a front-row seat as an official observer — part of a new push by Asia-Pacific countries to fortify their defenses against state-backed hackers.

Japan and Australia became members of NATO’s cyberdefense hub earlier this year. Singapore, meanwhile, is leading the Association of Southeast Asian Nations’ drive to deepen cybersecurity ties with the U.K. and Commonwealth countries. It is no secret the potential adversaries are states like Russia, China and North Korea.

The trio leads the world in state-sponsored cybercrime, according to a recent study by the Center for Strategic and International Studies in Washington and U.S. computer security company McAfee.

The latest drills, code-named Locked Shields 2018, were conducted on April 23-27 at NATO’s Cooperative Cyber Defense Center of Excellence in Tallinn, Estonia. Crimsonia carried out over 2,500 attacks on 4,000 pieces of Berylian infrastructure, including telecommunications systems, power plants and military bases.

Berylia’s buildings and IT networks were shown on computer displays, with miniature infrastructure flashing red as the attackers struck. More than 1,000 experts from 30 countries competed to display their defensive capabilities, testing their political, military and civil decision-making skills.

The drills, billed as the world’s largest and most advanced international live-fire cyberdefense exercises, have been held each year since 2010. Australian Foreign Minister Julie Bishop, in an April 23 news release, explained her country’s decision to get involved. “Now, more than ever, we must engage with the international community to set clear expectations for responsible state behavior in cyberspace.”

Brendan Thomas-Noone, a research fellow with the United States Studies Center at the University of Sydney, said that “the coordinated announcement from the U.S., the U.K. and Australia in April that Russia had conducted a cyberattack last year that infected global infrastructure” also played into Canberra’s decision.

Australian government said up to 400 of the country’s companies were affected by the attack. A more coordinated international response, and joint exercises between NATO and partners like Australia, may blunt the impact of future attacks or deter Russia from launching them, Thomas-Noone said.

Japan, which is enhancing its own cybersecurity standards, joined the NATO cyberdefense center in January when Prime Minister Shinzo Abe visited there, becoming the first Asia-Pacific country to do so. The government wants help from NATO and Western allies as Tokyo prepares to host the 2020 Olympics.

Japan, South Korea and Australia have all worked with NATO, but cyberspace is a relatively new area of cooperation. Experts from South Korea’s National Security Research Institute helped organize the event in Tallinn.

As for the U.K. and Singapore, they are spearheading cyberdefense buildups across the ASEAN bloc and the Commonwealth. They intend to focus on capacity-building, including the training of experts.

At the Commonwealth heads of government meeting in London in April, the pair and 51 other countries agreed to forge what they called the world’s largest cybersecurity pact. The goal is to bolster defenses by 2020, and the U.K. will set aside 15 million pounds ($20 million) for this purpose.

Singapore in late April chaired an ASEAN summit where members released a joint statement on cybersecurity cooperation “in recognition of the growing urgency and sophistication of transboundary cyberthreats.” The inaugural ASEAN-Australia special summit in March produced a similar pledge, and in yet another example of increased cooperation, ASEAN and Japan will open a joint cybersecurity center in Thailand in June.

Singapore also hosted a conference called Cybertech Asia in March to encourage cooperation between the public and private sectors.

As allies team up in cyberspace, questions linger over North Korea. Jun Osawa, a senior research fellow at the Nakasone Yasuhiro Peace Institute in Tokyo, said the North “could still be a threat” online even if relations with the U.S. improve after the expected summit between leader Kim Jong Un and President Donald Trump.

Osawa suggested the sanctions-hit country needs $1 billion a year to maintain the regime, and that the government uses ransomware and other attacks to obtain foreign currency from targeted companies. If negotiations with Washington falter, Osawa said, Pyongyang may step up attacks on the U.S., Japan and South Korea again.

asia.nikkei.com

Comments

Post a Comment